Complete Guide to How the Forex Market Works

If you are looking to start trading forex or if you are already a forex trader, you must have a basic understanding of how the industry works. Just like an electrician needs an understanding of how electricity works; forex traders need to understand the dynamics of the forex market.

Not only is this fundamental knowledge that will help guide many of your essential trading decisions, like which broker to use for example, but much of the material presented here is not well understood by many in the industry so you’ll gain a solid informational foundation to judge the strategies, lessons and training materials provided by others.

In this post you will gain an understanding of:

- How prices are set.

- The dynamics of the interdealer market

- Where you fit into the system

- What an over-the-counter market is

- What order flow is and how it can help our trading (spoiler alert – it can’t)

- The difference between dealing-desk and non-dealing desk brokers

- Stop Loss Hunting

- What brokers do with you orders and how this affects your risk and the spread

- Asymmetric information in the currency markets

- And more….

So lets begin.

Like Visuals?

Scroll to the bottom of the post for link to a Complete Whiteboard Explainer Video

Forex Market Structure

First, let’s look at the forex market operational structure.

The Forex Market is considered an Over the Counter (OTC) Market. What this means is that it is a decentralized market so there isn’t one main “hub” to clear all transactions and set prices. So price setting is done behind closed doors. It is very “opaque”.

At the center of the forex market are what are referred to as “market makers”. They “make a market” by playing both sides of the market – they are both buyers and sellers. They are also referred to as dealers.

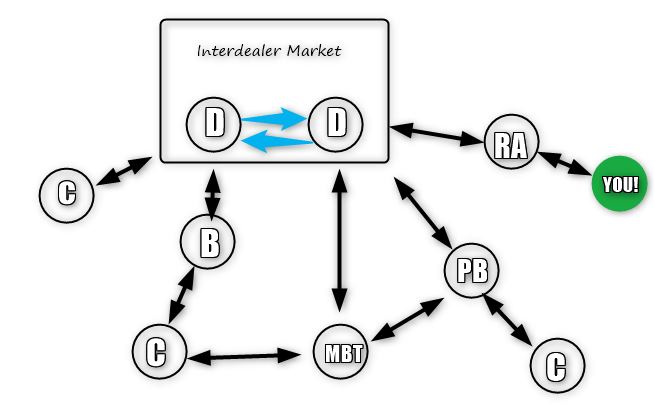

There of course isn’t just one dealer, there are several. The dealers trade currencies with each other on what is called the “interdealer market”.

These intermarket trades are very important as they help inform dealers about what prices to set for their customers. Dealers have an advantage in that through the orders that arrive at their desks, they have a lot of information at their disposal which can help them understand the outlook of their clients. Many of these clients are very well informed. So dealers watch closely the buying and selling operations of one another on the interdealer market as it gives them an idea of their customer’s market expectations. Well get more into the importance of the access to this information later.

So the dealers (D) make trades on the interdealer market but they also interact with non-dealer customers. They can interact directly with clients (C) and with other banks (B) which also have their own clients. They can interact directly with Prime Brokers (PB), who have clients as well. To facilitate trades they can place orders on a Multibank Trading System (MBT). And finally they also interact directly with Retail Aggregators (RA) and this is where you and your broker come into the picture.

Just as the name implies, Retail aggregators bundle retail trades into larger trades which can be then handled by the dealing banks. These are your brokers and there are different approaches of how they handle the trades of their clients.

Dealing and Non-Dealing Desk Brokerages

One method is that they and pass trades directly through to their dealers or whatever liquidity feed they are connected to. They essentially match the orders of their clients with their liquidity providers and pass the orders directly through the system. These types of brokers are typically referred to as ECN or STP brokers. They are referred to as non-dealing desks because they are not making the market by taking the other side of the trade but only passing trades through the system as a middle man.

Other brokers may use the ECN model but also act as dealers to the retail clients in that they may match your trade with their internal inventory. So what they are doing is that they are offsetting your trade with another one of their clients or they themselves may even act as the counterparty to your trade. Clearly, if your dealer is on the other side of your trade they would have an agenda for you to lose which is somewhat disturbing. These circumstances bring in the temptation to knock you out of your trade through what is often referred to as stop loss hunting.

These types of brokers are referred to as dealing desks as they are acting as dealers to their internal clients opposed to passing the trades straight through to a liquidity provider as the non-dealing desk does.

Pros and Cons of Brokerage Approaches

Those are the main differences between broker systems and you can now quickly understand the pros and cons of each type. Typically the brokers that also act as dealers have fixed spreads. Because they internalize a lot of the transactions they can set the spreads to a fixed rate higher than what their liquidity providers offer them. So this mark-up on spread gives them a bit of profit and it gives you some certainty of what you pay for each transaction.

Because non-dealing desks pass your trades straight through to their liquidity providers you get the advantage of a very tight spread – so you get a better rate. Yet the flip side is that these dealers have no control of the spreads so you are also subject to any type of volatility or widening spreads that might happen during lower liquidity sessions. With a dealing desk brokerage you are sheltered from this normal market behaviour through their fixed spreads; however, there is also the unsettling risk of your broker being on the other side of your trade and their motivation for you to lose. Whether they act on those opportunities or not certainly depends on the integrity and reputation of your broker. We’ve all heard stories but likely most brokers already make enough to keep transactions fair.

How Currency Prices are Set

Okay, so those are the players in the forex market structure. Now what typically happens for price setting is that each day the dealers take orders from their customers – so they get all their customers order flow. Just like the retail customer brokers they have some options of what they can do with the orders. They can keep them as inventory -this is referred to as holding risk on their books- or they can offload orders onto the interdealer market. What is interesting is that it has been reported that depending who the client is, dealers will treat orders differently. Through experience and sometimes with the assistance of algorithms they can determine which clients have better information about the market direction.

So imagine you are a dealer and you have a client that you know is perhaps over 80% correct about the market direction. You come into the office and have an order for them to go long $500,000 EURUSD at market. Because you are a market maker you must take the other side of the trade so you sell it to them. You are now in the very difficult situation of having a very short EURUSD position with the informational edge that the market is quite likely to go up. So what do you do?

What is often done is that they try to unload that losing trade back on the interdealer market as soon as possible. Not only will they unload that trade but they will often take their own internal positions in the same direction of the client. So this is what I meant earlier about dealers gaining information from the trades placed on the interdealer market. Orders on the interdealer market represent information from the clients of the dealers. Some of these clients are very well informed and often correct in their market outlook. So we have a trickle down effect of the large informed players placing trades, that information is embedded into the interdealer market through dealer trades. Dealers then use the pricing on the interdealer market to determine prices to set for their clients including your broker. So that’s how a dealer decides on what prices to set for its clients including your brokers.

So there is an asymmetry of information; some clients have better information than others. Now we’ll see how this asymmetry of information relates to order flow – a concept that is frequently misunderstood and misused.

Order flow is a term that is widely misinterpreted and it is important that you have a proper understanding of these concepts. So let’s look at what order flow actually is.

What Order Flow Really Is

Order flow is typically defined as “buy initiated trades minus sell initiated trades”. What does that mean? Well essentially it is the buying or selling pressure from signed transactions and this commonly gets misinterpreted as supply and demand – which it is not.

Order flow gained a lot of traction with economists and academics as it spawned out of a failure of macroeconomic models to explain fluctuations in exchange rates. Although most felt that fundamental attributes like: unemployment rate, inflation, interest rates, trade balance and so on, should be the information required to explain price movements; it turns out that over the short to intermediate term these features are actually very lousy predictors of price movement. Order flow on the other hand, has emerged as a model to explain currency pricing.

And you’re probably thinking, well of course, if order flow is really buying vs selling pressure that would explain changes in currency prices. And yes, it is somewhat intuitive but the hype behind the finding stems largely from a pretty significant departure from standard economic models and gave some critical insights into the inner workings of the interdealer market and the power of asymmetric information.

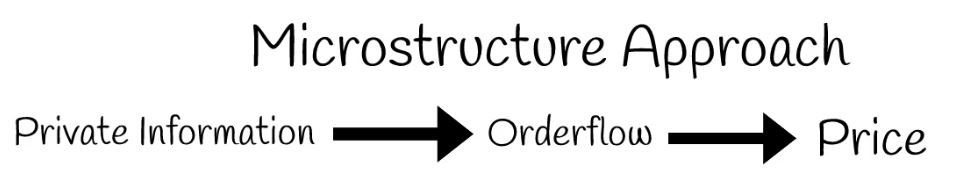

Without beating this to death let’s just dig in a bit deeper to make sure we have a grasp of the theory. So order flow comes out of a market microstructure approach which opposed to macro fundamental drivers of price, microstructure approaches generally look at things like the transmission of information between market participants, their behaviour, and of course order flows.

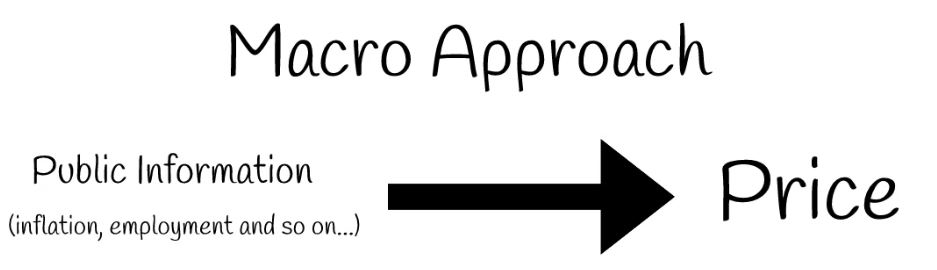

So the Macro approach would look like this.

Because economic data is publically available (like unemployment, inflation, interest rates etc…) this data is directly embedded in price and changes to these variables will directly influence the currency price.

The microstructure approach, on the other hand, emphasizes asymmetric information. That is, although economic data is publically available, not all players are equally able to interpret that data. Not everyone has access to sophisticated economical modeling and forecast tools. Some may even have access to data that is not yet publically known. This is what we mean by asymmetry in the information. Some players are simply better informed than others.

As explained earlier, dealers know which clients have these informational edges; they place trades accordingly on the interdealer market, which disperses that information through the interdealer market thereby allowing the dealers to set a price for clients to reflect that information. So in the end, what order flow really is, is information. Information that is critical to how dealers set prices. And the literature on this topic has shown time and time again that order flow affects short and intermediate pricing. Fundamentals, however, do remain a more accurate longer term model.

So order flow is unfortunately not some secret trading approach. It certainly was an important breakthrough and paradigm shift in economists thinking about currency prices. Unfortunately, this informational edge is not available to retail traders. It is exclusively at the dealers fingertips and it is powerful information. For example, Lyons in a 1995 paper reports that order flows helped dealers to “know” trade balance figures long before the statistics are publically published; which definitely is a clear informational advantage.

A final concept you should be aware of is that order flow is not the same as supply and demand. The best way to understand this is by knowing that the price impact of order flow differs based on the identity of the trader. So, for example, if order flow is actually more skewed to the buy side – say 2 times more buyers than sellers – but the seller is a client with a known informational advantage, in a classical supply demand model the price should move higher because there is more demand through the greater buying pressure. Yet in reality price may not move higher at all and hypothetically may even move lower based on whatever interactions occur at the interdealer market. So again, order flow is not supply and demand.

Who has an Informational Edge?

Okay, so who are these informed players? Several studies all suggest it is those that are profit motivated traders such as: banks, asset managers and hedge funds that tend to have this informational edge. And of course amongst those players more informational asymmetry exists. In contrast, it’s been found that corporate and private clients act more as liquidity providers especially during the overnight period. Banks tend to only keep limited overnight positions and otherwise “go flat” on their inventory before the day ends. So several studies have reported that the orders from corporate clients provide much of the liquidity in the overnight markets. And to tie that back to the earlier discussion, this would be the reason for high volatility and widening spreads when banks close at the end of major sessions like New York into Asia; especially if you are using an ECN to get direct access to dealer pricing.

How do i use this Information?

So this summary only gives a cursory overview of the forex market and leaves out many of the finer intricacies but it highlights some of the dynamics that are important to traders. Certainly you can use this info now to help inform your decisions on choosing a forex broker but the information is also fundamental to grasp some other related aspects of the market such as “revealed-liquidity” and currency market news absorption, which will be covered in other videos.

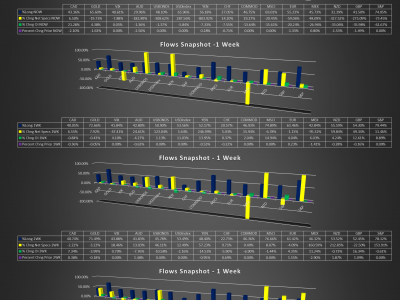

The important thing to keep in mind is that this information not only deepens our general understanding of the industry but is knowledge that will help inform our beliefs about what is the best market approach. For example, we are now in a better position to gauge the accuracy and relevance of those that reference supply and demand or order flow in their approaches. We also now understand that asymmetric information a very real and powerful phenomena in this industry. Although we can’t gain access to this informational edge directly you might be more prone to consider follow-the-money strategies through trend trading or using Commitment of Traders data to create strategies aligned with those who have that informational edge.

Either way, when our strategies and market approaches are developed using a bottom-up approach, based on sound information to inform our beliefs, we can create better strategies. And because they are aligned with our beliefs we’ll have more confidence in trading our strategies, which is half the battle in this profession. So keep learning!

Don’t Miss our Complete Guide to Commitment of Traders Data which can be used to create “follow the money” Strategies!