Free Analytical Tools and Resources

Charting Software – TradingView

Trading View is a very user friendly web-based trading platform. Most of my charting is done on Trading View, I then execute my trades on my brokers platform. I find the free version to be sufficient; although there are some limitations such as the amount of indicators available etc…

Forex Market Map

Usually before I even open at my charts I consult this Forex Market Map. It gives a quick overview of how currencies have been performing. At a glance I can detect the best and worst performers and look to see whether they have broad strength/weakness (strong/weak vs all or against only some).

After seeing the major FX market movers I look at the overall market dynamics with the tool below.

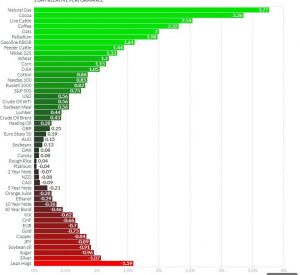

Market Movers

This FinViz snapshot of Futures performance is a great way to quickly get an overview the the general market movers. Use it to instantly detect intermarket relationships.

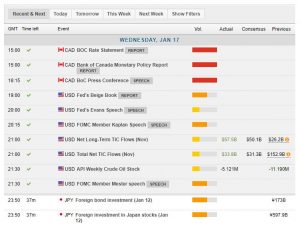

Economic Calendar – Forex Live

Although there are a number of calendars available online, I prefer Forex Live’s calendar because of the additional information it provides that can help you evaluate potential impact of the information. By clicking on the Data release you can access a chart showing:

- The Actual & Deviation History chart which tells you if an economic data surprised the market in the past compared to its expectation (consensus). A surprise generally generates a bigger impact (more movements) in the markets, including currencies.

- The True Range chart which shows the volatility of a currency pair in terms of pip variation 15 minutes and 4 hours after the data release. That may indicate what potential this data has to move the markets again in the future.

- A Volatility Ratio chart tells you if the movements of a specific pair are usual or exceptional.

- Finally a scatter plot chart relates the Deviation with the True Range in pips. It illustrates how volatile a currency pair can be after a data release created a surprise (deviation between actual and consensus) in the markets. That can help me deduce how much pips a pair can move in the future based on the deviation between the actual number and the expected number of an upcoming economic data release.

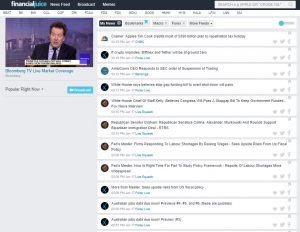

News Feed – Financial Juice

Financial Juice provides a good free news stream. You can customize the streams that come across your feed. They’ve even embedded Bloomberg Live to be streamed at the same time.

Currency Correlations

Mataf provides a standard currency correlation chart (among other tools) which is very helpful to consult before adding a new position – especially if already have other open positions.

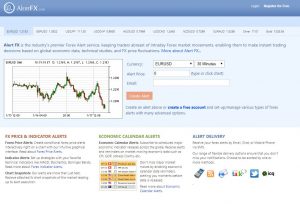

Free Alerts

If you don’t have access to Alerts through your broker or platform – Alert FX is the solution.

They provide Forex Price Alerts, Indicator Alerts (notifications if MAs cross, RSI overbought/sold etc…) and Economic Calendar alerts.

What’s really neat about them is you can get notifications that include a snapshot of the price action leading up to the alert.

Market Research

eFX Data

eFX News recently changed to “eFX Data” which regularly posts institutional positional strategies and market outlooks. Most of the information is available through the subscription service (eFX Data Plus) but the free resources are an excellent feed as well

Scotiabank FX Daily Update

Scotiabank FX provides a good thorough overview of the FX market. It is a helpful daily consult, especially if you are primarily trading the NY session.

Citibank Weekly FX Insight

Citibank produces a great weekly FX market overview. It highlights the upcoming week’s market moving events including positioning strategies for several pairs.

JP Morgan Research Library

JP Morgan Research library has just that – JP Morgan research – but also includes market recaps, LTCMA podcast episodes and more.

Software

Arxzm Trading Software

If you haven’t come across Arxzm yet, check out WISDOM and FORTRESS and see what they can do for your trading. FORTRESS offers incredible freedom to capture trades while you are away from your screen and WISDOM is essential for technical analysis. NOW AVAILABLE FOR FREE THROUGH SWORDANDSHIELDFOREX.COM – CLICK HERE

Forextester

If you haven’t felt the need to trade on simulation software (using real data), I can assure you, you will. Forextester was a critical part of my learning process to trade and continues to be my go-to software to test new strategies.

Brokers

Beginners Recommendation – Oanda

Oanda has one distinct advantage for beginners – nano lots. Nano lots allow a trader to take exceptionally small position sizes and allows for highly customizable risk exposure. They also have an excellent mobile platform, analytical tools, and a news feed worth opening a demo account to access.

Advanced Traders and Money Managers – Mt Cook Financial

For advanced traders or for those that intend on managing other peoples money via a Signal Service, Copy trades, or Managed Accounts structure, Mt Cook is hard to beat. Advanced traders will enjoy the tight spreads, straight through processing (STP) of their ECN or deep liquidity of their DMA account. All orders are STP so they don’t hold risk on their books and you can be assured they won’t take trades against you – they don’t operate a “B Book”.

For money managers their Hybrid PAM software is simply unmatched. The advantages are too many to list here. There are significant differences in MAM/PAM software so it is important to do your homework. Check them out, and if you intend on managing in the future, I suggest you start building your track record here.