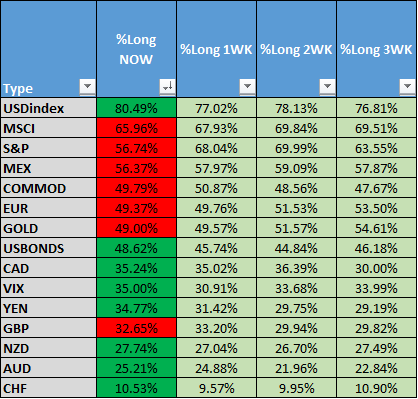

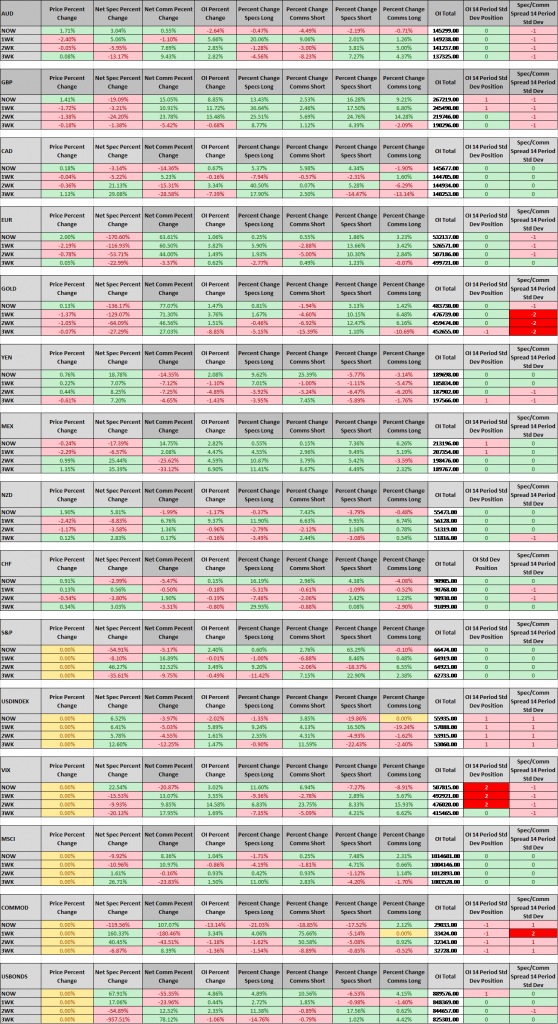

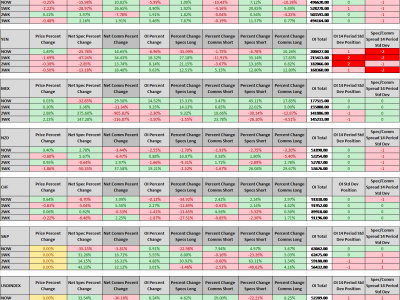

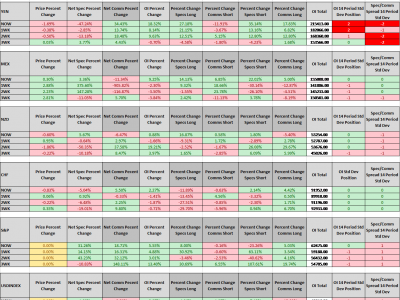

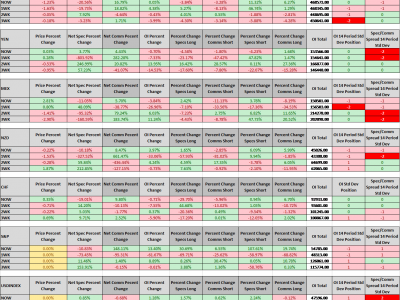

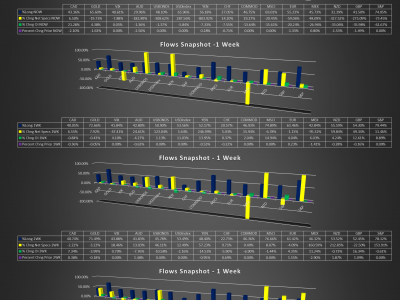

This week we see some positioning across asset classes that suggests some Risk Aversion.

A significant element of the positioning is a major shift in S&P Net speculator positioning – an asset class correlated to risk sentiment. Looking at players individual positioning, we see that this shift in positioning was due to sellers entering the market. Opposed to indications of profit taking or bull squeezes, this large amount of new sellers is a strong bearish signal that shouldn’t be overlooked.

We look for opportunities in the Forex Market through positioning in Risk Currencies – the Japanese Yen and Swiss Franc.

The Yen presents a “harmony” positioning – a bullish consensus move among all players. Looking at Open Interest and Net positioning it suggests there is room for more bulls to enter the market – if the risk positioning persists.

The Swiss Franc on the other hand, offers a different opportunity. Tracking Open Interest suggests a major low in the USDCHF may offer a liquidity pool of stops built up over the longer term bull trend. Therefore, it is a situation of a squeeze opposed to a bullish move presented in the Yen.

Video Below

Raw Charts